As parents, it is in our nature to want to provide our children with the best start in life. However providing for children can be expensive and with prices rising it is not likely to be cheaper any time soon. Which is why saving for the future is so important

Some parents wish to give children a head start in life by helping them to acquire their first car, assisting them with university fees, contributing towards their wedding or towards a housing deposit. However, for the average Joe it is not affordable, unless we have a strategic plan in place to save for the future of our children, such as a dedicated children’s savings plan.

According to research from money.co.uk, parents need an estimated £259,000 to cover those expenses. Whilst this total is daunting, focusing on a more specific goal such as saving for a housing deposit, a car or university fees can help you to set more realistic saving goals. However, our own research tells us that 65% of parents said that if they had a savings plan in place; they would pay just £10-£50 a month.

Money.co.uk discovered that 28% admitted that saving wasn’t an option as they looked at it as a luxury they cannot afford. However, we at Shepherds Friendly and many other providers offer saving options that could help you to save more for your child, such as a Junior ISA, where family and friends can also contribute on behalf of the child and any capital growth is tax free.

Friendly societies (such as us) offer many tax-efficient plans which could make your savings go further. Find out more about our tax exempt savings plans for children.

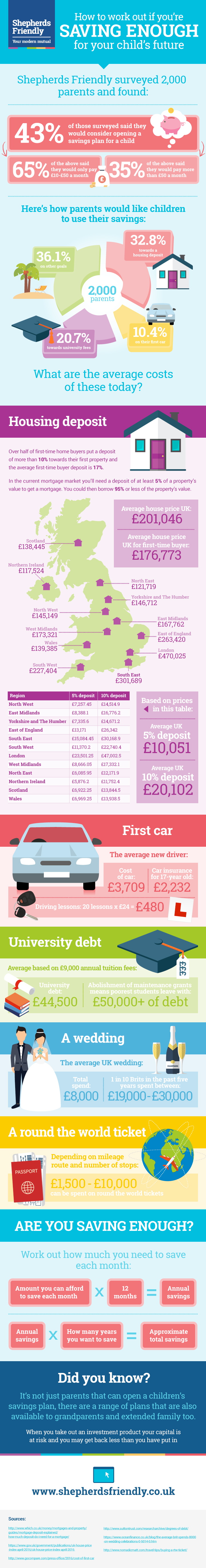

Our infographic below helps you consider whether you are saving enough to reach a savings goal for the future of your child.

* Please bear in mind that these statistics are approximations and were based on research in 2016*

Text Version: How to work out if you’re saving enough for your child’s future

Shepherds Friendly surveyed 2,000 parents and found:

43% of those surveyed said they would consider opening a savings plan for a child

65% of the above said they would only pay £10-£50 a month

35% said they would pay more than £50 a month

Here’s how parents would like children to use their savings:

32.8% towards a housing deposit

10.4% on their first car

20.7% towards university fees

36.1% on other goals

What are the average costs of these today?

Housing deposit

Over half of first-time home buyers put a deposit of more than 10% towards their first property and the average first-time buyer deposit is 17%.

In the current mortgage market you’ll need a deposit of at least 5% of a property’s value to get a mortgage. You could then borrow 95% or less of the property’s value.

Average house price UK: £209,054

Average house price UK for first time buyer

Average House Price: £176,773

| Region | Average House price |

| North West | £145,149 |

| East Midlands | £167,762 |

| Yorkshire and The Humber | £146,712 |

| East of England | £263,420 |

| South East | £301,689 |

| South West | £227,404 |

| London | £470,025 |

| West Midlands | £173,321 |

| North East | £121,719 |

| Northern Ireland | £117,524 |

| Scotland | £138,445 |

| Wales | £139,385 |

Based on prices in table below:

Average 5% deposit In UK: £11,206.60

Average 10% deposit in UK: £22,413.23

| Region | 5% deposit | 10% deposit |

| North West | £7,257.45 | £14,514.9 |

| East Midlands | £8,388.1 | £16,776.2 |

| Yorkshire and The Humber | £7,335.6 | £14,671.2 |

| East of England | £13,171 | £26,342 |

| South East | £15,084.45 | £30,168.9 |

| South West | £11,370.2 | £22,740.4 |

| London | £23,501.25 | £47,002.5 |

| West Midlands | £8,666.05 | £17,332.1 |

| North East | £6,085.95 | £12,171.9 |

| Northern Ireland | £5,876.2 | £11,752.4 |

| Scotland | £6,922.25 | £13,844.5 |

| Wales | £6,969.25 | £13,938.5 |

First car

The average new driver:

Cost of car £3,709

Car insurance £2,232

Driving lessons: 20 lessons x 24 = £480

University debt

Average based on £9,000 annual tuition fees:

University debt: £44,500

Abolishment of maintenance grants means poorest students leave with: £50,000+ of debt

A wedding

The average UK wedding:

Total spend: £8,000

1 in 10 Brits in the past five years spent between £19,000-£30,000

A round the world ticket

Depending on mileage route and number of stops:

£1,500-£10,000 can be spent on round the world tickets.

Are you saving enough?

Amount you can afford to save each month x 12 months = Annual savings

Annual savings x How many years you want to save =Approximate total savings

Did you know?

It’s not just parents that can open a children’s saving plan, there are a range of plans that are also available to grandparents and extended family too.

When you take out an investment product your capital is at risk and you may get back less than you have put in.

Embed our infographic using the code below: