Junior ISA

Open a Junior ISA from just £10 per month, and you can invest in your child’s future with a plan you can count on. When you invest, your capital is at risk.

Total reviews

2965

Average rating

4.61

left to use your 2024/25 Junior ISA allowance

Junior ISAs explained

A Junior ISA (JISA), or child’s ISA, is a tax-efficient savings or investment account which allows you to gift a tax-free lump sum to your child as soon as they turn 18. It allows you to invest in their future without paying income tax or Capital Gains tax on the returns.

Junior ISAs can be set up by a parent or guardian to help their child fund any future ambitions. Whether it’s their first car, to go towards a housing deposit or to help fund their university education, they’re an efficient method of investing over the long-term.

About our Junior ISA

Our Junior ISA enables you to invest tax-free towards a lump sum for your child when they turn 18. Invest up to £9,000 a year with the flexibility to make regular or one-off payments.

- The fund aims for higher returns than you’d get with a cash ISA or bank account, by paying quarterly bonuses every three months

- Deposit from just £10 per month or make a one-off payment of as little as £100

- Friends and family members can pay in, too.

Thanks to smart investment decisions by the fund managers, our Junior ISA has been able to pay a bonus since the plan launched in 2011.

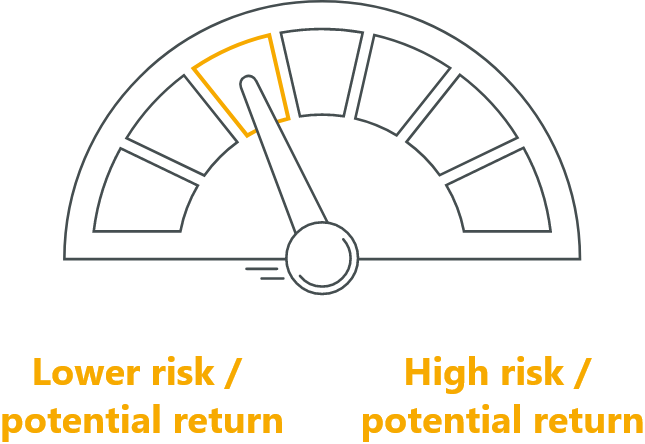

However, the value of investments can fall, so you may get back less than you invest.

Who can open a Junior ISA?

A Junior ISA can only be opened by a child’s parent or legal guardian. Once the Junior ISA has been opened, family and friends can contribute to the child’s future goals. This can be done through one-off top-ups or a monthly Direct Debit from just £10, making it a popular way to make cash gifts on birthdays and special events like Christmas.

How much can I invest in a Junior ISA?

The Junior ISA allowance is £9,000 for the current tax year, but tax rules may change in the future. This is the maximum total amount that can be deposited into a Junior ISA in each tax year (6 April to 5 April).

A child can only hold one stocks and shares Junior ISA each tax year, but they can also hold a cash Junior ISA. The Junior ISA allowance can be spread across both types of plan, as long as you do not exceed the overall allowance. For example, if you invested £6,000 into a stocks and shares Junior ISA, then you would be able to save another £3,000 into a cash Junior ISA.

We provide an investment plan to set your child up for life

Simple to set up

Parents or guardians can open a plan online in minutes. Then make monthly Direct Debit payments or a single lump sum.

Easy to manage

Manage your plan online, on the mobile app, or with the help of our Member Services Team. Pause, top up or change your payments anytime.

Brighten their future

When your child turns 18, they will receive a lump sum as a special birthday present

How we manage your investments

Nothing matters more than your child’s future, so when you choose our Junior ISA, we invest carefully and wisely on your behalf.

How we invest

- following periods of strong investment performance, you might get a final bonus

- or, following periods of poor investment performance, you may get back less than the current value of your plan.

Where we invest our Junior ISA

How we’re regulated

Why we’re trusted at Shepherds Friendly

Please keep in mind that when you take out an investment product with us your capital is at risk and you may get back less than you have put in.

Small, simple steps that make a big difference to their future

Open your Junior ISA online

You’ll be done in the time it takes to make a cup of tea.

Login & manage your account

Access your secure online account 24/7.

Help grow their investment

Top up at any time. Friends and family can contribute, too!

18th birthday surprise

The big day arrives – present them with a tax-free cash gift.

Because everyone can benefit

As a mutual, we’re built on fairness. We can pay more profits to our members because we’re owned by them, rather than shareholders. It also means you’ll have a say in how we’re run. So when you open a Shepherds Friendly Junior ISA, you’re not only helping to secure your child’s future but you’re helping to define ours.

Our members love that we do things the right way

Nine out of 10 members would recommend our responsible investing to a friend.

Helping our members benefit for almost 200 years

The world’s changed a lot since 1826, but our idea of fairness remains the same.

When you’re member-owned, it matters more

We take the financial future of every member personally, because you’re one of us.

Open a Junior ISA for your child and kickstart their investment journey with up to £100 cashback into their plan

Once your child’s first deposit has been received, they will receive an ‘ISA Boost’ within 30 days. An ‘ISA Boost’ is cashback paid directly into their plan, equal to the value of the first deposit, up to the value of £100. See our terms and conditions for more details.

Ready to start investing in your child's future?

It’s important to know what you’re signing up for, so the download below explains all about our Junior ISA. Remember that when you invest, your capital is at risk.

Find out more about our Junior ISAs

Frequently asked questions

-

Can I open more than one Junior ISA?

A child can only have one stocks and shares Junior ISA, but they can also hold a cash Junior ISA. However, they can’t hold a Junior ISA as well as a Child Trust Fund – although a Child Trust Fund can be transferred into a Junior ISA.

-

What age can you open a Junior ISA?

A Junior ISA can be opened for your child from the day they’re born until they turn 18. To open a Junior ISA you must be the child’s parent or legal guardian, be aged 16+ and a UK resident. Also, while you can manage your child’s plan while they’re younger, they have the option to manage it themselves once they turn 16.

-

What can your child do when they turn 18?

Your child can access the money and decide what to do with it. They could transfer it automatically to an adult ISA and keep saving, or withdraw some or all of the money. They could use it to pay for things like university, a home deposit, or a car.

-

Can you make withdrawals from a Junior ISA?

No. Withdrawals cannot be made until your child turns 18.

-

Can I transfer an existing Junior ISA?

Absolutely. If your child already has a Child Trust Fund or a Junior ISA (cash or stocks and shares), it’s easy to transfer it to a Shepherds Friendly Junior ISA. Only the named parent or guardian can do this.

Our Member Services Team are always happy to help.

You can call them on 0800 526 249.

Important things to consider about Junior ISA

- Past performance cannot be taken as a guarantee of future returns.

- The value of the JISA depends on the future performance of the investments held in the fund and the bonuses we distribute from any profits arising from these investments.

- HM Revenue and Customs may change the tax status of a Junior ISA in the future.

- Inflation may affect the purchasing value of the investment in the future.

- The money invested into a Junior ISA cannot be withdrawn early; it can only be withdrawn by the child when they reach the age of 18 years old.

- We will calculate the value of your investments in the With-Profits Fund if you transfer your plan elsewhere or leave the money invested for more than 3 months after the child’s 18th birthday. We do this to ensure you receive your fair share. If you have been invested through periods of poor investment performance, you may get back less than the current value of your plan. This is known as a Market Value Reduction (MVR).

When you take out an investment product with us your capital is at risk and you may get back less than you have put in. All references to taxation are to UK taxation and are based on Shepherds Friendly Society’s understanding of current legislation and H M Revenue and Customs practice which may change in the future.

Investment growth is by means of bonuses, the amount of which cannot be guaranteed throughout the term of the contract. Please ensure that you read the full terms and conditions of this plan which are available from your financial adviser or by contacting us directly.

Please note: Shepherds Friendly has not given any advice. Contact a financial adviser if you have doubts about whether a investment plan is suitable for you. There may be a charge for financial advice, and the cost should be confirmed to you before any advice is given.