If you have recently started, or you are about to start university, it may be the first time you’ve lived away from your parents and have had to fend for yourself. It can be a little daunting moving to somewhere new, therefore it is important that you fully prepare yourself for this big change before starting your first semester. A good start is creating a student budget.

You may be going into your second, third or fourth year of university but found that last year you were scraping the barrel for cash at the end of each month; this guide will help you to budget your finances so that you can manage your money more effectively.

University is an exciting time where you focus on your career, meet new friends and become part of a new social scene. If you don’t create a student budget you could find yourself hard up for cash, meaning you might miss out on the things you enjoy, while struggling to afford the essentials.

Here you can find helpful tips and a downloadable month-by-month student budgeting guide to stick on your noticeboard as a reminder. This university budgeting resource will help you to budget your income each month so that you can meet your bills and also attend the big event that the whole of campus seems to be talking about.

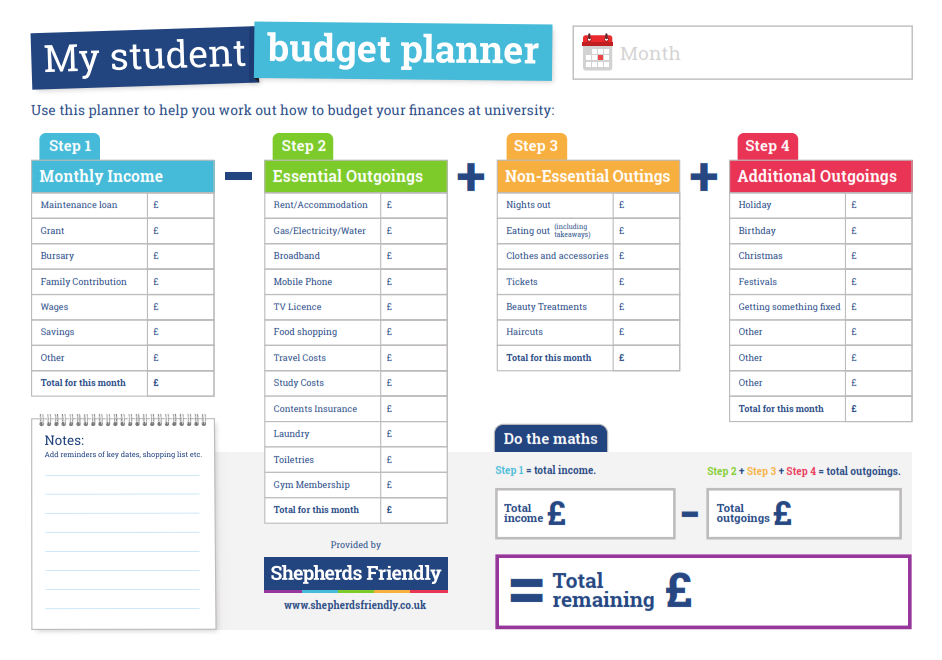

Print the student budget planner off at the end of each month and fill it in based on the month ahead. Click here to download the student budget planner:

Before you start – Consider the following:

Your money needs to last all term.

– Don’t go on a spending spree as soon as it enters your account.

– Can you accumulate some savings before you go?

Set up a student bank account.

– Do your research on student bank accounts for the best deal.

– Look out for an account which has an interest free overdraft.

– Don’t choose a student account because of the freebies on offer.

Don’t forget to sort out your student finance so you know how much you will be receiving from your student loan provider per installment (if needed).

Teach yourself the difference between wants and needs.

– Do you really need that new pair of shoes for a night out?

How to use the student budget planner:

Tip: It is best to fill out the form in pencil to begin with in case you have to change step 3 and/or step 4

Step 1: Start by working out your monthly income. Add each of your incomes together to make a total income amount and then add it in the total income box in the ‘do the maths’ section.

Tip: With regards to your student maintenance loan divide the amount you receive in instalment 1 by how many weeks are in the term and then check how many weeks are in that month to spread it out fairly.

Step 2: Calculate the cost of your bills that are necessities. These may include rent, your phone bill, food shopping etc. Add them together to make a total.

Step 3: Work out things you would like to do this month but you could do without (having this as a separate section will help you cut down on outgoings if you notice you’ve gone over this month). Calculate the total.

Step 4: Is there someone’s Birthday this month? Do you want to go on holiday, or is there a particular event that you really want to go to? Add it here in the additional outgoings section and see if it’s affordable this month.

Step 5: Add step 2, 3, and 4 together to calculate your total outgoings and add it to the appropriate box in the ‘do the maths’ section’.

Step 6: Subtract your total outgoings from your total income to calculate your total remaining amount.

Not got enough income for your outgoings?

Increase your income – Have you considered a part time job during your days off university? Could your parents contribute?

Reduce your expenditure – Is there anything you could take out of step 3 or 4? Remember the difference between wants and needs.

Speak to an adviser – Most universities have a student money adviser who can help you manage your income and suggest solutions.

Consider borrowing options –Only consider this option if no other options are available as you could be creating a larger debt for yourself. Remember the less you borrow the better your financial situation should be when you finish university.

What can I do with my ‘total remaining’ budget?

If you have money left over in a month, you need to think about the best way to invest it to get the most for your money.

Do your budget for the following month. Will you need it then? Do you have some big event coming up that you could do with saving for?

Add it into a savings plan. It could make your money go further and may stop you being tempted from spending it on something you don’t really need. You can find out more about our savings plan here.

It is important you think about the most sensible options on what to do with your total remaining.