From rising food costs to an increase in the price of utility bills, many of us are feeling the pinch at the moment. The current financial climate has made saving money even harder than usual, but how much of an impact has it really had on our ability to put money aside, and where do Britain’s best savers reside?

We’ve surveyed 2,000 Brits on their saving habits to reveal how much they have in their savings as well as how much they usually save per month. We’ve also taken a look at how Britain’s saving habits are changing as a result of the cost of living crisis, revealing where we are making the biggest changes to protect ourselves for the future.

Brits state they need £35,000 in their savings to feel financially secure during the cost of living crisis

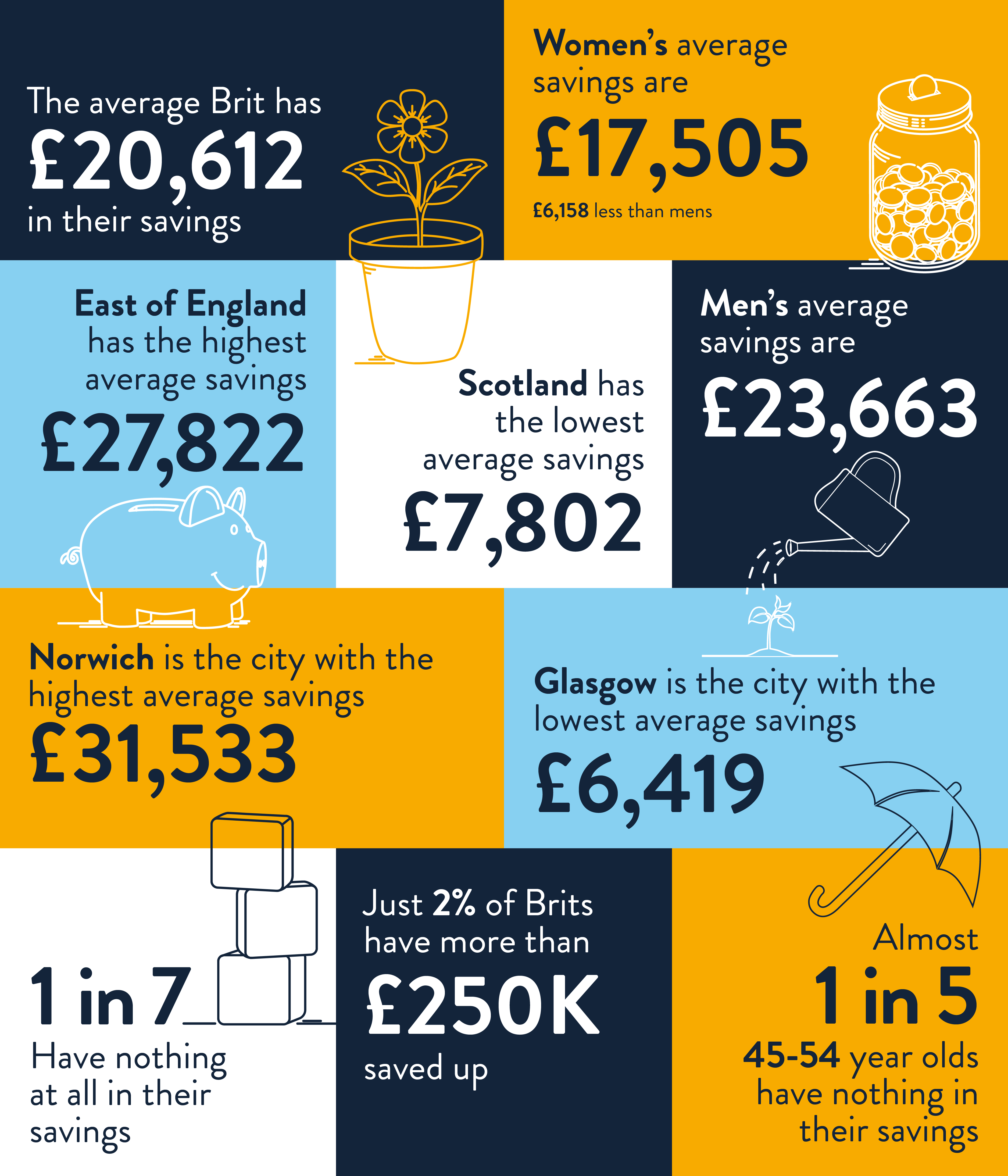

Our survey revealed that people in the UK have an average of £20,612 in their savings, jumping to £23,332 for those who have joint savings with a partner. Meanwhile, almost one in seven individuals currently have nothing at all in their savings, and around one in six have £500 or less.

Breaking this down by location, residents in the East of England have the most money in their savings (£27,822 on average) with Norwich being the city that has the most saved up in the UK (£31,533 on average). Meanwhile, we found Glaswegians have the lowest amount in their savings at £6,419.

Average amount each city surveyed has in savings:

| Rank | City | Average amount residents have in their savings (Individual savings) |

|---|---|---|

| 1 | Norwich | £31,533 |

| 2 | Brighton | £31,385 |

| 3 | Cardiff | £29,310 |

| 4 | Birmingham | £23,790 |

| 5 | Sheffield | £22,899 |

| 6 | London | £22,846 |

| 7 | Manchester | £22,519 |

| 8 | Liverpool | £21,165 |

| 9 | Nottingham | £20,992 |

| 10 | Leeds | £20,650 |

| 11 | Newcastle | £17,380 |

| 12 | Plymouth | £16,542 |

| 13 | Bristol | £15,257 |

| 14 | Southampton | £12,060 |

| 15 | Belfast | £10,593 |

| 16 | Edinburgh | £9,504 |

| 17 | Glasgow | £6,419 |

Looking at how much each age group surveyed has in their savings on average, it might not come as a surprise that 18-24 year olds were revealed to have the least (£12,756), whilst those aged 55+ have the most (£29,184).

Meanwhile, those aged 35-44 have the second highest amount in their savings, £3,828 more than those aged 45-54 who have the third highest amount saved up. Interestingly, almost two in five 45-54 year olds have either £500 or less in their savings with almost one in five having nothing saved up at all.

Average amount each age group has in their savings:

| Rank | Age group | Average amount age groups have in their savings (Individual savings) |

|---|---|---|

| 1 | 55+ | £29,184 |

| 2 | 35-44 | £19,046 |

| 3 | 45-54 | £15,218 |

| 4 | 25-34 | £14,229 |

| 5 | 18-24 | £12,756 |

Despite this, in order to feel financially secure, our respondents stated that they think they would’ve needed at least £28,477 saved up before the cost of living crisis. However, in the context of the cost of living crisis, they now think that they would need at least £35,366 saved up to feel financially secure, an increase of 24%.

18-24 year olds answered that a total average savings of £12,017 would have made them feel financially secure before the cost of living crisis. However, they now think that they need at least £28,959 saved up on average to feel financially secure. At an increase of 141%, this is the highest rise of all the generations surveyed.

UK residents think they need to earn close to £40,000 yearly to feel financially secure during the cost of living crisis

When it comes to the annual income people think they need to feel financially secure, we found £39,913 was the average. This is £3,716 more than what Brits think they needed before the cost of living crisis, at £36,197.

Interestingly, male respondents considered £39,118 to be a comfortable annual salary before the cost of living crisis compared to £33,162 for women, a difference of almost £6,000 a year. However, the cost of living crisis has reduced this gap, with men now considering £41,208 an ideal annual salary, compared to women who answered £38,557 – a difference of just over £2,500 a year.

Respondents in Southampton think they need to earn the most in the context of the cost of living crisis, £45,334 on average per year, compared to those in London who answered £42,537. Meanwhile, residents in Belfast think they need the biggest increase in their salary, revealing that £32,766 per year would have made them feel financially secure before the cost of living crisis, compared to £40,073 during the crisis, which is an increase of £7,307 on average.

Most Brits have reduced their monthly savings since the rise of the cost of living crisis

The cost of living crisis has undoubtedly made saving money more difficult for many. Our survey has shown that, whilst some people are putting more money in their savings each month, the majority are putting less away each month compared to before the cost of living crisis began.

Whether it’s increasing savings for more financial security, or taking savings out to support with the rising costs of goods, we’ve explored how much residents in cities across the UK are saving now versus before the cost of living crisis.

Our survey revealed that monthly savings for residents in Leeds have decreased the most during the cost of living crisis, down £179 per month compared to before the cost of living crisis. Meanwhile, residents in Manchester are being the most savvy with their money, increasing their monthly savings by £148 on average compared to before the cost of living crisis.

Londoners are the only Brits following the 50/30/20 saving rule

There are many different saving ‘rules’ you can follow to help you grow your personal savings. One of the most common is the 50/30/20 method, where you divide your income into three separate chunks; 50% for essentials such as rent, mortgage repayments and bills, 30% for items and experiences that are non-essential such as meals out or travel, then 20% for your savings.

Our survey highlighted that London is the only city where residents are following this efficient saving rule with respondents in the capital currently saving 22% of their monthly income on average (compared to 24% before the cost of living crisis). Currently, people in the UK are saving an average of 17% of their salary, which was 19% before the cost of living crisis began.

On the other hand, residents in Brighton are saving just 9% of their income every month currently, compared to 11% before the cost of living crisis, the lowest percentage saved per month out of all cities analysed. Meanwhile, Glaswegians have seen the highest drop in monthly savings as a percentage of their salary, down from 18% before the cost of living crisis to 10% now.

How have people’s saving habits been affected by the cost of living crisis?

With the current financial climate making it even trickier to set money aside, and one in seven admitting that their finances are causing them serious stress and worry (13%), we’ve delved into exactly how Brits’ saving habits have changed since the rise of the cost of living crisis.

To help with saving money during the cost of living crisis, just under a third of respondents (29%) revealed that they have set up a savings account and 21% have set up a cash ISA. Meanwhile, almost one in five (18%) have set up a stocks and shares ISA to help boost their savings.

Whether it’s saving for a first home or setting aside some money for an emergency fund, finding the right ISA for your saving goals is a great way to encourage you to save each month. Furthermore, you’ll also be able to save money without paying tax on your interest or investment growth, leaving you better off in the long run.

Gen-Z are taking out over £4,000 a year for non-essential items during the cost of living crisis

Whilst most of us will try not to dip into our savings, sometimes it is necessary to do so, especially in the current financial climate. In fact, our survey revealed that Brits are currently dipping into their savings every 30 days on average for essentials and every 23 days for non-essential items.

We asked our respondents how much they take out of their savings per month during the cost of living crisis compared to before for both essentials and non-essential items. From this, we found that the average person in the UK is taking less out of their savings each month for non-essentials, but are taking more out for essentials.

On average, our respondents took out £182 from their savings for essential items before the cost of living crisis compared to £216 during the cost of living crisis, a £34 increase on average per month (£408 a year). Meanwhile they were taking out £219 per month for non-essentials before the cost of living crisis and £187 for non-essentials during the cost of living crisis, a decrease of £32 a month, a saving of £384 a year.

| Item | Avg. amount taken out of savings monthly BEFORE cost of living crisis | Avg. amount taken out of savings monthly SINCE cost of living crisis | Difference | Total saving/loss over the course of a year |

|---|---|---|---|---|

| Essential items | £182 | £216 | -£34 | -£408 |

| Non-essential items | £219 | £187 | +£32 | +£384 |

Surprisingly, 18-24 year olds revealed that they were taking £423 out of their savings per month on average (£5,076 a year) for non-essentials before the cost of living crisis, and are still taking £338 out per month (£4,056 a year) for non-essentials during the cost of living crisis. This is more than every other generation surveyed.

Meanwhile, those aged 45-54 take the least out of their savings for non-essentials per month (£74 before the cost of living crisis versus £71 during the cost of living crisis).

A holiday abroad is the top thing Brits are saving for in 2023, with spending on takeaways and new clothing being the main areas we’re cutting down on

We asked our respondents what they are currently saving towards, with over a quarter (26%) stating they’re saving towards a holiday abroad, making this the most common thing people are building up their personal funds for.

We discovered saving for a holiday is one of the main goals people have when it comes to managing their money, followed by 18% saving for a rainy day. Women are more likely to save for a rainy day (22%) compared to men (14%). Meanwhile, just 6% of respondents aged 18-24 are saving for a rainy day, followed by 23% of those aged 45-54.

The top things people in the UK are currently saving for:

| What Brits are saving for | Percentage of Brits saving for this |

|---|---|

| A holiday abroad | 26% |

| A rainy day | 18% |

| A holiday in the UK | 15% |

| Retirement | 13% |

| A car | 12% |

| Home renovation | 11% |

| Christmas | 10% |

| Family birthday presents | 10% |

| A TV / laptop | 8% |

| Their children's birthday presents | 8% |

With many Brits holidaying within the UK in the past few years, our survey revealed that 15% of us are currently saving towards this, followed by retirement (13%), and a new car (12%). Meanwhile, more than one in 10 (11%) revealed that they are currently unable to save any money at all.

When asking our respondents where they’re making cutbacks since the rise of the cost of living crisis, takeaways came out on top with almost half (46%) stating that they have reduced their spending in this area. This is followed by new clothing (43%) and socialising with friends (33%).

With rising food prices, it might not come as a surprise that a third of our respondents are cutting down on the amount spent on food shopping whilst more than one in six are making cuts to their spending on utilities (17%).

Saving money isn’t always easy and it can often feel like the list of things we need to pay out for is never ending, whether it’s utility bills, birthday gifts or a holiday. Our research shows that the average UK resident has changed their spending and saving habits due to the cost of living crisis, with many making positive changes towards building their savings, whether that’s opening an ISA or dipping into their savings less and less every month.

Tips to help your money go further in 2023

With many of us attempting to be savvier with our money in recent times, we’ve put together some quick tips on how you can make your money go further in 2023.

- Use your ISA allowance

With your ISA allowance resetting every April, this allows you to save up to £20,000 tax free each year. From lifetime ISAs to stocks and shares ISAs, these savings accounts are a great way to grow your savings without having to worry about paying tax on your savings or investment growth, so it’s worth seeing which options are the best for you and your savings goals.

2. Utilise tax relief schemes

If you’re self-employed, you can claim tax relief for things like travel costs and clothing expenses. You may also be able to claim tax relief on work uniforms and specialist clothing that need to be cleaned, repaired or replaced.

If you’re a parent, you can also utilise the tax-free childcare scheme to claim back 25% of your childcare costs. Through this scheme, you can get up to £2,000 a year per child to help with childcare costs, increasing to £4,000 a year if a child is disabled.

- Review your mortgage if you’re on a variable rate

If you’re not on a fixed-rate mortgage, it can be beneficial to keep a lookout for a better deal. Reviewing your mortgage deal when interest rates are cut, for example, can help you to see a drop in your rate. Mortgage deals change daily, so it’s worth keeping on top of what’s out there to make sure you’re getting the most competitive deal.

- Monitor your utility usage

With utility bills on the rise, monitoring your usage can help to reduce your spending in this area. Doing so could also lead to a positive change in your habits, such as turning lights off in an empty room, or switching off appliances when they’re not in use.

- Sell unwanted items online

Do you have unwanted items lying around the house? From clothes to homeware, there are plenty of people online looking for a bargain, so it can be a good idea to consider selling your unwanted items to make some extra cash. You can sell second hand goods via sites like eBay, Facebook Marketplace, Depop and Vinted. If you’re looking to treat yourself, these sites are also a great way to shops sustainably whilst making sure you’re getting the best deal!

At Shepherds Friendly, we have a range of savings plans for helping you protect and grow your finances. Check out more about how we can help you save here.

Methodology & Sources

We surveyed 2,003 Brits aged 18 and over in April 2023 on their spending and saving habits. The research was conducted between 06/04/2023 and 12/04/2023.