Understanding finances is important when it comes to navigating life’s many challenges, yet it’s a skill that doesn’t come naturally to everyone. Many of us find financial terms and concepts confusing or overwhelming, and it can feel like we’re speaking a different language when discussing money matters.

To see how much Brits truly understand about finance, we’ve quizzed 2,000 people from across the UK, testing their knowledge on topics including ISAs, investing, life insurance, and general personal finance. Through a series of 40 questions, we uncovered what people are well-versed in and where they might be lacking when it comes to understanding their finances.

We’ve also delved deeper into Brits’ feelings towards their personal finances, revealing what financial regrets they have, as well as their confidence when it comes to dealing with different areas of personal finance.

Just under half of Brits passed the money literacy test

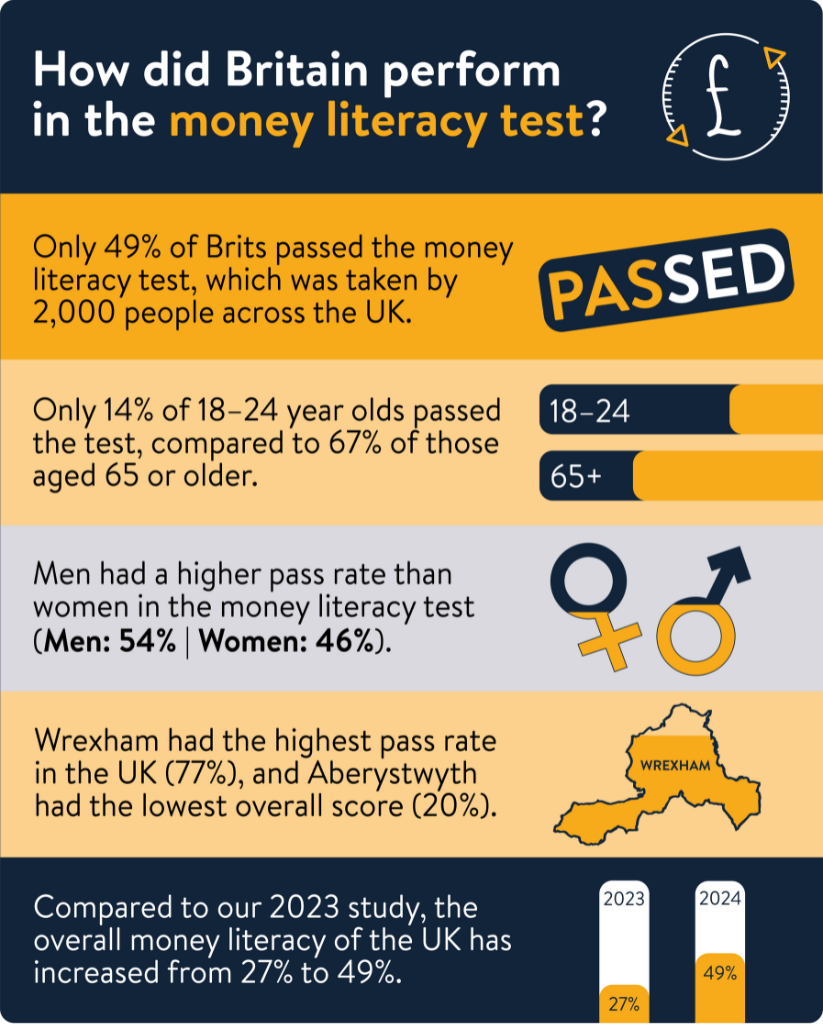

It turns out that the nation is almost evenly split when it comes to financial literacy. Our survey results showed that about 49% of people passed the money literacy test, suggesting that a significant portion of the population has a good understanding of essential financial topics. However, this also means that over half of people in the UK (51%), are still uncertain about common financial terms.

The breakdown of the results by age group shows a clear trend: financial literacy tends to improve with age. It’s perhaps unsurprising that younger people have the least knowledge about finances, with only 14% of those aged 18-24 passing the test. This percentage rises to 30% for those aged 25-34 and continues to increase, with 67% of people aged 65 and over passing, the highest of any age group.

| Age Group | Percentage That Passed | Percentage That Failed |

|---|---|---|

| 18-24 | 14% | 86% |

| 25-34 | 30% | 70% |

| 35-44 | 46% | 54% |

| 45-54 | 56% | 44% |

| 55-64 | 64% | 36% |

| 65 and over | 67% | 33% |

Looking at results by gender, there are some interesting patterns. Overall, 54% of men passed the test, while 46% of women did. But when it came to understanding personal finances, women actually outperformed men—74% of women got these questions right, compared to 71% of men. On the flip side, men know more about investing, with 53% passing this section of the quiz compared to 40% of women.

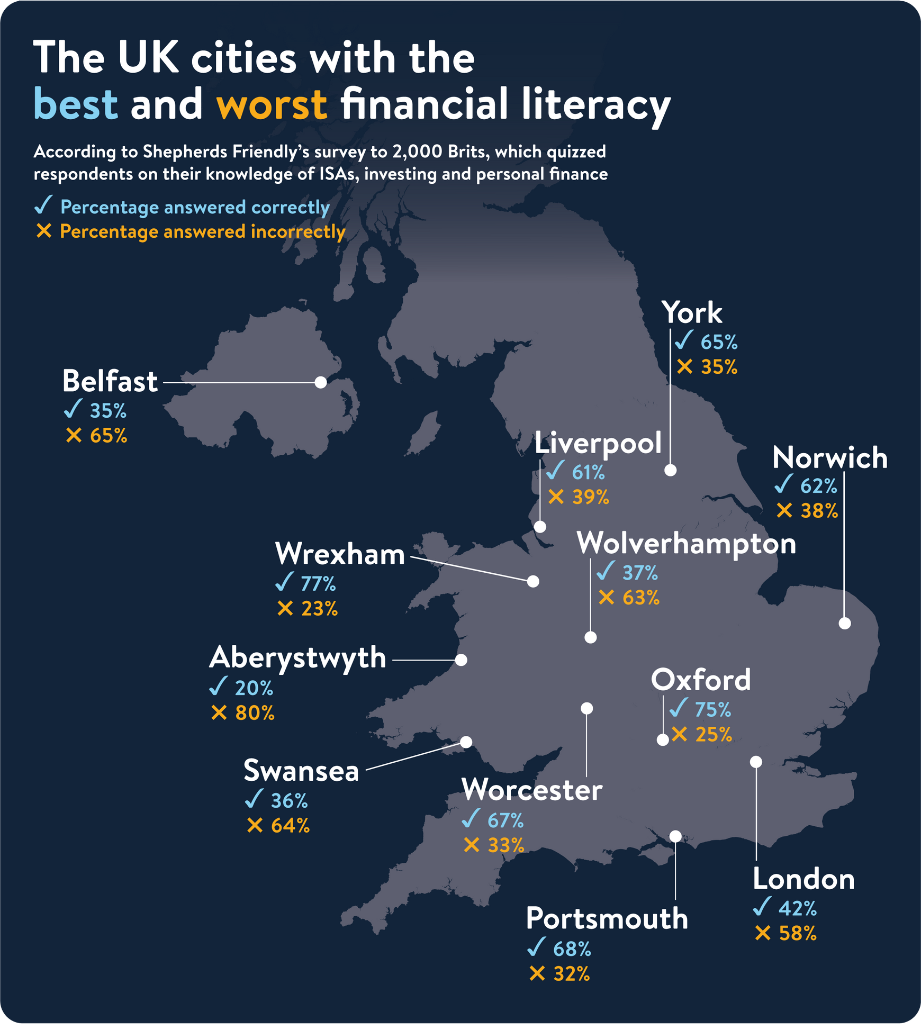

Breaking down the data by location, we identified the cities that have the highest and lowest pass rates when it comes to all aspects of financial literacy, including ISAs, personal finance and investing. Here’s what we found:

Wrexham leads the way with a 77% pass rate, showing that many people here understand financial concepts well. Oxford comes next with a 75% pass rate, and Portsmouth is in third place, with 68% of its residents passing the test.

At the other end of the scale, Aberystwyth in Wales had the highest fail rate of any city, with just 20% passing the money literacy test, meaning 80% failed. Belfast had the second-lowest pass rate of 35%, followed by Swansea with just 36% of the respondents here passing the test. London also makes the top 10 list of cities with the lowest pass rate, with 42% of residents passing our test.

ISAs revealed to be the biggest personal finance topic Brits struggle with the most, followed by investing

Surprisingly, respondents were more likely to fail the section of the quiz on the topic of ISAs over investing, which can be an incredibly complicated finance topic. Just 44% of respondents passed the test on ISAs, compared to 46% on investing, 69% on life insurance and 72% on general personal finance.

| Area of Quiz | Percentage That Passed | Percentage That Failed |

|---|---|---|

| Personal Finance | 72% | 56% |

| Life Insurance | 69% | 31% |

| Investing | 46% | 54% |

| ISAs | 44% | 56% |

Just 22% of those aged 18-24 passed the section of the quiz on ISAs, followed by 30% of 25-34 year olds. Over half of respondents (54%) incorrectly thought that you have to pay a tax on investment gains made from saving into an ISA once it hits a certain amount, which is incorrect. In fact, all interest earned from saving into ISAs are free from Capital Gains Tax.

46% of respondents incorrectly thought that you can only have one ISA per tax year. In reality, there is no limit to the amount of ISAs you can have at any one time, as long as you don’t go over the £20,000 annual saving limit. Whilst savers have always been allowed to have more than one ISA open at the same time, it wasn’t possible to open more than one new ISA account each tax year. However, as of April 2024, you can now open more than one new ISA per tax year, apart from Lifetime ISAs.

Meanwhile, investing revealed to be the second topic Brits struggle with the most. Interestingly, 70% of respondents answered that you have to be at least 18 before you start to invest, however young people can invest sooner as long as they have a parent or guardian involved, for example investing into a Junior ISA.

47% of respondents answered that real estate is the least risky form of investment and 39% thought that stocks that go up in price must come back down. In reality, while real estate can be a relatively safer type of investment, there’s no way to predict what will happen in the future, and there’s also no way you can predict what will happen to a stock if it goes up in price. Investing carries risk, and you must remember that you are putting your capital at risk when doing so.

14% of respondents thought that you have to have at least £20,000 saved up before you invest, however, there’s no set limit you need to be able to get started with investing. Before investing, however, it’s important to understand that investing is more appropriate if you have long-term saving goals, and you put your capital at risk when doing so. Therefore, you must seriously consider what you can afford to put in.

Men are more confident than women on many personal finance topics

When asking respondents how confident they felt on different money topics, we’ve found that men are much more confident in certain areas despite the pass rate of the quiz being almost equal, and women outperforming men on certain topics.

Questioned about their confidence on Stocks and Shares ISAs, 56% of men said they felt confident on this topic compared to just 29% of women. 72% of men feel confident in their knowledge of cash ISAs compared to 55% of women, meanwhile 76% of men are confident in their knowledge of everyday savings accounts compared to 58% of women.

When it comes to personal finance in general, 91% of men feel confident compared to 83% of women.

The UK’s biggest financial regret is not building up savings while young

We all have financial decisions we regret. For many of us, learning from experiences and improving our financial knowledge helps us to make less ‘mistakes’ as we grow older.

Financial regrets often come from a lack of understanding, especially around the long-term consequences of our choices. With 27% of respondents agreeing that they made financial decisions when they were younger that they now regret, many people find themselves looking back and wishing they had made different decisions.

However, it’s never too late to start learning. Gaining financial literacy can empower you to make more informed choices that align with your long-term goals, helping you avoid future regrets. From our survey, we found out the top ten financial decisions people in the UK regret:

| Rank | Financial Regret | Percentage of People Who Say This Is a Financial Regret |

|---|---|---|

| 1 | Not building up my savings when I was younger | 56% |

| 2 | Not investing my money sooner | 47% |

| 3 | Not teaching myself more about money topics | 43% |

| 4 | Not saving into a pension | 39% |

| 5 | Not investing enough | 38% |

| 5 | Not saving enough into my pension | 38% |

| 6 | Not saving for an emergency fund | 37% |

| 7 | Not investing my money | 35% |

| 7 | Not budgeting my money | 35% |

| 8 | Not saving enough for an emergency fund | 32% |

The most common regret, expressed by 56% of respondents, is not building up savings when they were younger, showing the significance of establishing a habit of saving early in life to provide financial security and flexibility in the future.

The second-most prevalent financial regret Brits feel is not investing money sooner (47%), answered by those who currently hold investments. Other key regrets include not teaching ourselves about money topics sooner (43%) and not saving into a pension (39%).

Additionally, 37% of those without an emergency fund express regret over not saving for one, a sentiment most strongly felt among younger generations with 48% of 25-34 year olds regret not saving for one. Only 60% of Brits actually have an emergency fund, with the 55-64 age group being the most likely to do so (73%). For those that do have an emergency fund, 32% regret not saving enough into one.

Other financial regrets include using buy now pay later schemes. Our survey revealed that almost a third (30%) have used these schemes at some point in their lives (increasing to 40% for 35-44 year olds), however almost a quarter (22%) went on to regret it. This regret was felt most strongly by Gen-Z’s (36%). While buy now pay later schemes can help with spreading costs, users should be wary of incurring fees for late payments, which can also damage credit scores.

Interestingly, just 13% of Brits said they regret not taking out life insurance and just 37% of respondents revealed to actually have taken out this policy, showing the importance of being informed about financial products and planning ahead. Life insurance can be incredibly useful for providing financial security to our loved ones upon the event of death, helping to lessen the burden of unexpected bills and funeral costs.

Buying a house too soon is Britain’s least significant regret with just 6% of homeowners stating this. However, this increased to 17% of those aged 25-34, making them the most likely age group to have this regret.

One in six say that finances negatively affect their mental health

For many Brits, financial worries aren’t just about numbers—they also impact their mental well-being. More than one in six people say that their finances have negatively affected their mental health. This is especially true for younger adults; nearly 29% of 18-24 year olds feel that financial pressures weigh heavily on their minds. In contrast, only 4% of those over 65 report the same, perhaps reflecting more financial stability in later life.

Understanding finances can also be a significant source of stress. About 15% of people feel overwhelmed just trying to make sense of their money matters. This feeling is particularly common among 25-34 year olds, with 28% of them finding it stressful to manage their finances. Not far behind, 26% of 18-24 year olds also struggle with financial stress. With one in five 18-24 year olds admitting that they know more about events in popular culture than they do their own personal finances, it’s important that young people take the time to understand their finances and fill in knowledge gaps.

60% believe that finances should be taught in schools

As our survey results reveal, many of us are still uncertain about financial concepts, so it might not come as a surprise that 60% of people in the UK believe financial education should be taught in schools. Not only this, but a further 45% of us feel that young people do not have enough opportunities to learn about personal finance. Additionally, 29% of adults express a desire to improve their understanding of personal finance for better future planning.

Education on personal finance topics is currently limited in schools and it isn’t compulsory for schools to add it to their curriculums. However, learning more about personal finance from a younger age, for example how to pay taxes and apply for a mortgage, as well as how to save effectively, could have a big impact with helping people have less financial worries and regrets as they get older.

How does Britain’s confidence in personal finance topics in 2024 compare to 2023?

When surveying Brits about their confidence in personal finance topics in 2023, just 41% said they were confident in their knowledge compared to 87% in 2024. Furthermore, just 48% felt confident in managing their finances compared to 84% in 2024. With 2023 being a difficult time for many financially with the cost of living continuing to rise, this might answer why many felt less in control of their personal finances than usual.

In general, people also revealed to be more confident in their knowledge of ISA types in 2024 with 63% feeling confident about Cash ISAs and 42% saying they feel confident in their understanding of Stocks and Shares ISAs compared to 36% and 27% in 2023.

Furthermore, in 2023, 36% of people said that their finances had a negative impact on their mental health compared to 17% in 2024. Meanwhile, 35% in 2023 said their finances make them feel stressed compared to 15% in 2024.

What does this mean for the future of financial knowledge?

Graham Drummond, Head of Communications at Shepherds Friendly says, “Our survey showed that many people are unsure about things like budgeting, investing, and understanding financial products that can help them prepare for the future, such as ISAs and investing. It’s not just about knowing the terms, but really feeling confident in making decisions that affect our financial well-being. To close these knowledge gaps, we believe it’s crucial to start teaching financial literacy in schools and continue promoting it throughout our lives.

“There’s also onus on providers of financial products to ensure that their products, websites and literature are simple to understand, so consumers can be confident in the choices they are making when it comes to their money. That’s something we’re committed to at Shepherds Friendly. While we can’t offer advice, we aim to be a jargon free zone and try to educate people about our products and financial topics, so they can make informed decisions for themselves.

“Whether you’re looking to improve your money skills or just starting out with building up your savings, there are plenty of ways to learn. You can explore online resources, join a workshop, or chat with a financial advisor. By boosting our financial knowledge, we can all make smarter choices, feel more secure, and build a better future for ourselves and our families.”

Methodology

Survey of 2,000 UK adults was conducted in July 2024.

The pass rate of the quiz was calculated by finding the percentage of respondents who got 70% or more of the quiz questions on ISAs, investing, personal finance and life insurance correct.

Respondent pools for city-level data vary from 5 respondents to 405 respondents.